Unlocking the Future of Financial Services with SwiftVirtualPay.com

In today's fast-paced digital economy, the demand for efficient financial services has never been greater. This is where swiftvirtualpay.com comes into play, providing a comprehensive platform designed to streamline virtual payments and boost your financial management experience. This article explores the multifaceted offerings of SwiftVirtualPay.com, focusing on its core categories: Financial Services, Financial Advising, and Currency Exchange.

1. Understanding Financial Services in the Digital Age

Financial services encompass a broad range of economic services provided by the finance industry, which includes industries that manage money, such as banks, credit unions, insurance companies, stock brokers, investment funds, and real estate firms. The digital transformation in finance has led to a revolution in how these services are delivered, fostering greater accessibility, efficiency, and customization.

SwiftVirtualPay.com stands at the forefront of this transformation by offering innovative solutions that cater to the needs of individuals and businesses alike. By leveraging advanced technologies such as blockchain and AI, the platform ensures a swift, smooth, and secure user experience.

2. The Advantages of Using SwiftVirtualPay.com for Financial Services

2.1. Speed and Efficiency

One of the primary advantages of swiftvirtualpay.com is its focus on providing speedy transactions. Users can process payments in a fraction of the time it takes traditional banks or financial institutions. This efficiency is particularly beneficial for businesses that rely on quick payment processing to manage cash flow effectively.

2.2. Security and Reliability

Security is a paramount concern in financial transactions. SwiftVirtualPay.com employs state-of-the-art security measures to protect users' sensitive information and financial data. With seamless encryption protocols and adherence to industry standards, users can confidently engage in virtual transactions knowing their data is secure.

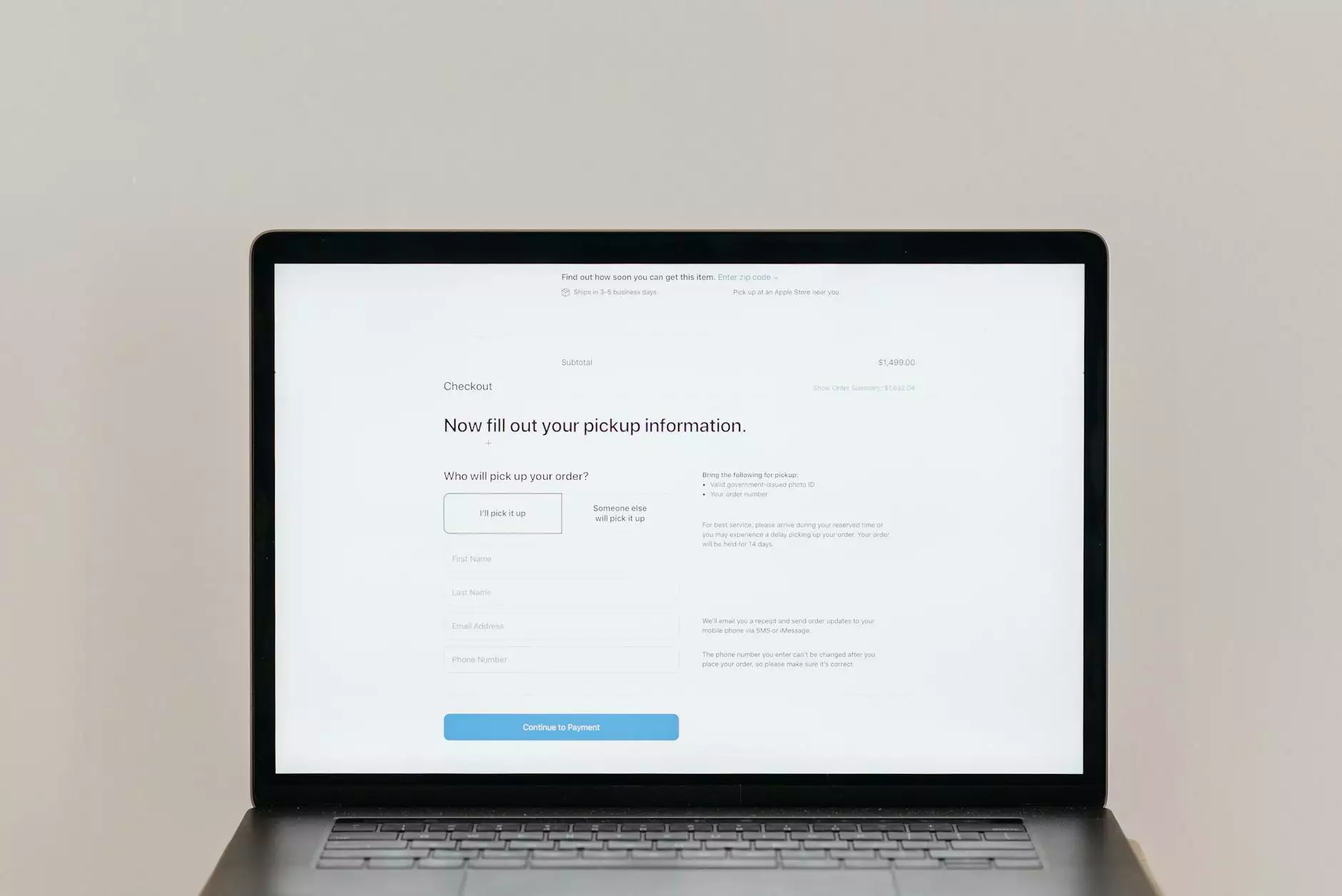

2.3. User-Friendly Interface

Navigating financial services can often be overwhelming, but SwiftVirtualPay.com boasts a user-friendly interface designed to simplify the process for everyone. Whether you’re a tech-savvy entrepreneur or a newcomer to digital finance, the intuitive layout ensures that all users can make payments, track transactions, and manage their finances with ease.

3. Comprehensive Financial Advising Services

Successful financial management is not just about fast transactions; it also requires knowledgeable financial advising. SwiftVirtualPay.com goes beyond traditional payment services by offering personalized financial advice tailored to meet the specific needs of its clientele.

3.1. Tailored Financial Strategies

At swiftvirtualpay.com, expert financial advisors work closely with clients to develop tailored strategies that optimize financial performance. This proactive approach not only assists in immediate financial needs but also establishes a roadmap for long-term growth and sustainability.

3.2. Expert Insights and Market Analysis

Keeping abreast of market trends is crucial for making informed financial decisions. The advisory team at SwiftVirtualPay.com provides clients with insights and analysis on current market conditions. Such information empowers clients to capitalize on opportunities and mitigate risks effectively.

4. Facilitating Effortless Currency Exchange

In an increasingly globalized economy, currency exchange plays a vital role in conducting international business. SwiftVirtualPay.com excels in providing an efficient and accessible platform for currency exchange, ensuring that users can transact across borders without unnecessary delays or complications.

4.1. Real-Time Exchange Rates

One of the standout features of swiftvirtualpay.com is its access to real-time exchange rates, which allows users to make informed decisions about currency conversions. This transparency in pricing helps users avoid hidden fees and ensures they get the best value for their money.

4.2. Low Transaction Costs

Traditional financial institutions often burden users with high fees for currency exchange. In contrast, SwiftVirtualPay.com operates on a model that prioritizes low transaction costs, making it a cost-effective solution for individuals and businesses looking to manage international transactions.

5. The Future of Digital Payment Solutions

As technology continues to evolve, so too does the landscape of financial services. The future of digital payment solutions looks promising, and swiftvirtualpay.com is committed to staying ahead of the curve. Here are some anticipated trends that will shape the industry:

- Increased Adoption of Cryptocurrencies: As cryptocurrencies gain acceptance, platforms like SwiftVirtualPay.com will likely integrate digital currencies into their payment systems.

- Enhanced Mobile Payment Solutions: With the ubiquity of smartphones, mobile payment options will increasingly dominate the market.

- AI and Machine Learning: Diving deeper into personalized finance, AI will help streamline services and create more customized financial plans.

- Greater Focus on Sustainability: Financial services will increasingly incorporate environmentally sustainable practices, an area where swiftvirtualpay.com can lead the way.

6. Conclusion

In conclusion, SwiftVirtualPay.com is more than just a virtual payment platform; it is a comprehensive financial service that provides invaluable resources to navigate the complexities of modern finance. With a commitment to speed, efficiency, security, and personalized financial advising, users can trust SwiftVirtualPay.com to meet their financial needs.

As we look to the future, it is clear that SwiftVirtualPay.com will play a vital role in shaping the financial services landscape, making it an indispensable partner for anyone looking to enhance their financial journey.